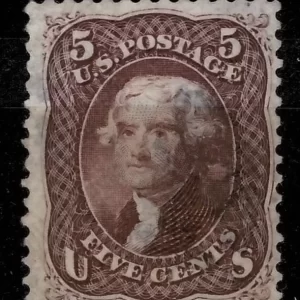

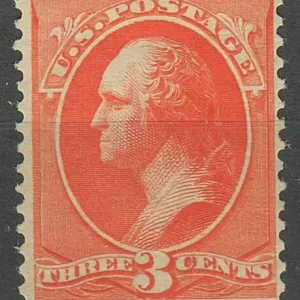

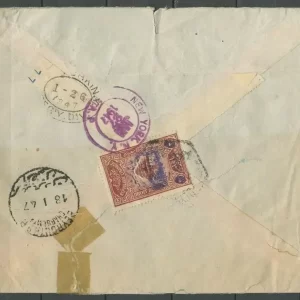

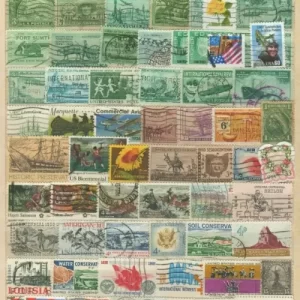

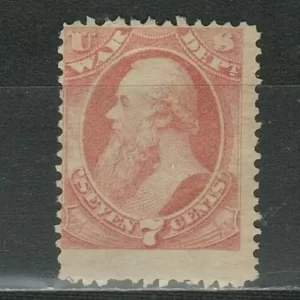

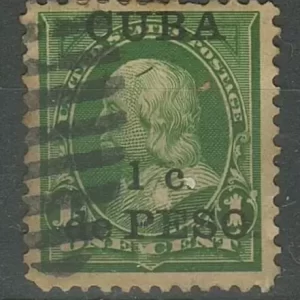

USA revenue Stamps 1860/1900 year Used lot

During the period from 1860 to 1900, revenue stamps were an important part of the United States’ fiscal system. These stamps were used to collect taxes on various transactions and documents, serving as proof that the required taxes had been paid. Here are some key points regarding revenue stamps in the USA during this time frame:

- Civil War Era (1861-1865): The outbreak of the Civil War in 1861 led to increased government spending and the need for additional revenue. Revenue stamps were issued to generate funds for the war effort. These stamps were used on documents such as legal papers, checks, and promissory notes.

- First Revenue Stamps: The first revenue stamps in the United States were issued in 1862. They featured various designs and denominations, often depicting patriotic symbols or important figures.

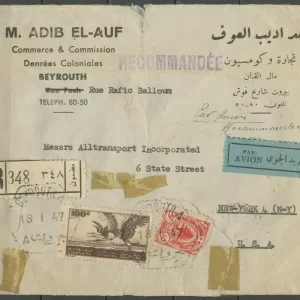

- Wide Range of Uses: Revenue stamps were applied to a wide range of documents and transactions, including bank checks, bonds, deeds, liquor licenses, proprietary stamps (used for medicines, perfumes, cosmetics, playing cards, etc.), and documentary stamps (used for legal documents).

- Special Tax Stamps: Special tax stamps were introduced during this period to regulate certain industries, such as alcohol, tobacco, and firearms. These stamps were affixed to products or issued to individuals or businesses engaged in these activities.

- Evolution of Designs: Over the years, revenue stamp designs evolved, reflecting changes in government policies and aesthetics. Some stamps featured intricate designs, while others were more utilitarian in appearance.

- Continued Use Post-Civil War: Revenue stamps remained in use after the Civil War, as the government continued to rely on various forms of taxation to fund its operations.

- Revenue Act of 1898: The Revenue Act of 1898 made significant changes to the taxation system in the United States, including the introduction of new revenue stamps and the restructuring of existing taxes.

- Transition to Internal Revenue Service: In 1862, the Bureau of Internal Revenue was established to oversee the collection of internal taxes, including those collected through revenue stamps. Over time, the bureau evolved into the modern Internal Revenue Service (IRS), which continues to administer the federal tax system in the United States.

Reviews

There are no reviews yet.